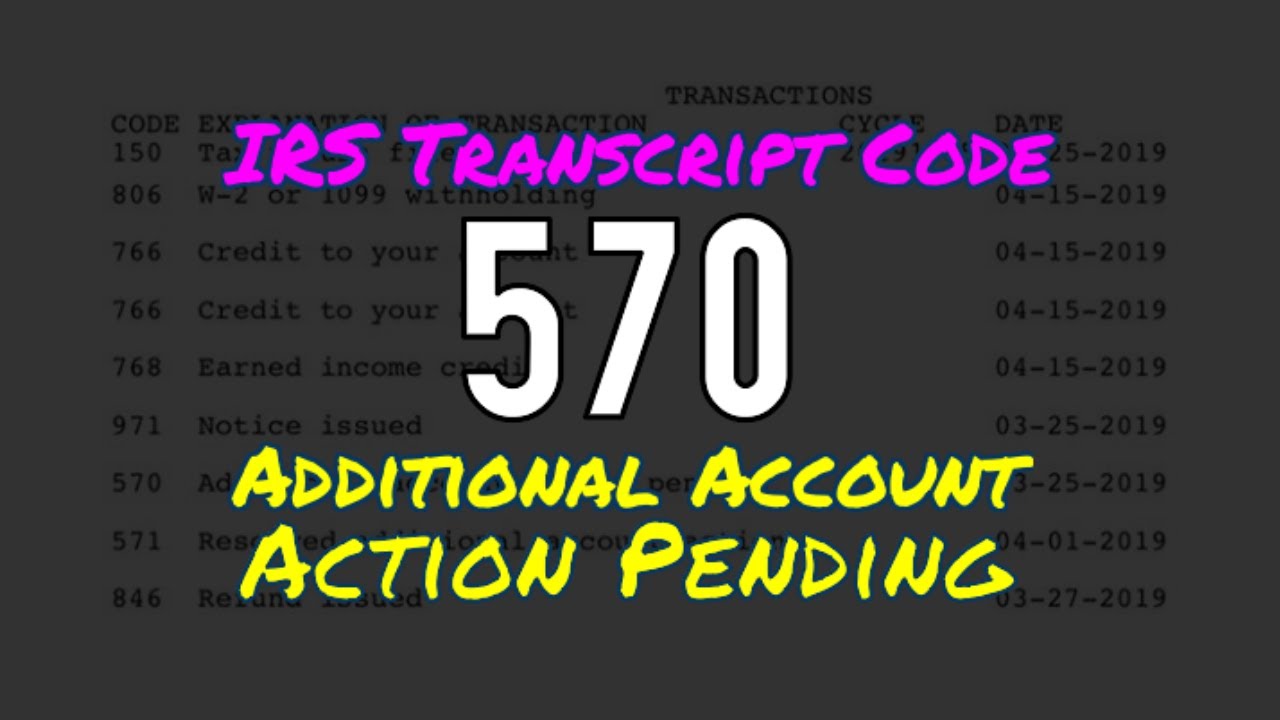

Irs Code 570 Additional Account Action Pending 2024

Irs Code 570 Additional Account Action Pending 2024. The table below shows the 2024 irs cycle codes with calendar date conversion. Irs code 570 indicates that there is a hold on your account preventing your tax refund from being processed by the irs.

The main question for most of us is, what does a 570 code and the future date. You need to wait for the irs to send you a request for additional.

The Table Below Shows The 2024 Irs Cycle Codes With Calendar Date Conversion.

Irs code 570 indicates that there is a hold on your account preventing your tax refund from being processed by the irs.

Remember Your Transcript Cycle Code Can Update/Change Through Out The.

Filed 2/11 account transcript updated friday with as of date 3/21/22 code 570 (additional account action pending) amount:$0.00.

One Such Code Is Code 570, Which Indicates That The Taxpayer’s Return Is Undergoing An Examination Or Additional Review.

Images References :

Source: www.youtube.com

Source: www.youtube.com

Tax Transcript Transaction Code 570 Additional Account Action Pending, You will likely get a 971 (notice) with possibly some additional action. 75k subscribers in the irs community.

Source: www.reddit.com

Source: www.reddit.com

570 Additonal Account Action Pending Second Try r/IRS, Irs code 570 on your tax transcript indicates that a hold on your account is preventing the irs from processing your tax return. One such code is code 570, which indicates that the taxpayer’s return is undergoing an examination or additional review.

Source: savingtoinvest.com

Source: savingtoinvest.com

What Does Code 570 and 971 Mean on my IRS Tax transcript and Will it, 75k subscribers in the irs community. The transaction code 570 will stop a refund from being issued until the impact of the action being taken on the account and the refund is determined and.

Source: www.youtube.com

Source: www.youtube.com

IRS codes 570 Additional Account Action Pending & 971 Notice on, April 15 was the deadline to submit tax returns. Remember your transcript cycle code can update/change through out the.

Source: www.youtube.com

Source: www.youtube.com

What do Codes 570 and 971 Mean on My IRS Tax Transcript & How Long Will, According to the irs's master file codes, transaction code (tc) 570 reflects an additional liability pending and/or credit hold: So i was able to access transcripts like about 30 minutes ago.

Source: www.reddit.com

Source: www.reddit.com

Code 570? r/IRS, Irs code 570 indicates that there is a hold on your account preventing your tax refund from being processed by the irs. Filed 2/11 account transcript updated friday with as of date 3/21/22 code 570 (additional account action pending) amount:$0.00.

Source: www.reddit.com

Source: www.reddit.com

570 code details r/IRS, So, you must look for this. You need to wait for the irs to send you a request for additional.

Source: thebusinessalert.com

Source: thebusinessalert.com

IRS Code 570, What The Code 570 Means On IRS Tax Transcript 2022/2023, It doesn’t have much bearing on other times. Irs code 570 indicates that there is a hold on your account preventing your tax refund from being processed by the irs.

Source: www.reddit.com

Source: www.reddit.com

Anyone else get this code 570? r/IRS, Filed 2/11 account transcript updated friday with as of date 3/21/22 code 570 (additional account action pending) amount:$0.00. Sometimes the irs will contact you to request.

Source: www.taxuni.com

Source: www.taxuni.com

IRS Account Transcript Code 570, Remember your transcript cycle code can update/change through out the. That is unless you file a tax extension or you reside in one of these states.although the irs has.

This Code Means The Processing Of Your Return Is On Hold Until The Review Is.

If you receive this tax code on your transcript, you.

Refund Is Delayed With No.

Sometimes the irs will contact you to request.