Capital Gains Tax Exemption 2025/25

Capital Gains Tax Exemption 2025/25

From april 2023, the uk capital gains tax allowance (“cgt”) will be reduced from £12,300 to £6,000 for individuals and personal representative for the 2023/24 tax year and then. Based on the statement, capital gains tax (cgt) exemptions would undergo a reduction starting in april 2023, followed by additional decreases from april.

They are entitled to business asset disposal relief and have. For the tax year 2023 to 2025 the aea will be £6,000 for individuals and personal.

They Are Entitled To Business Asset Disposal Relief And Have.

Individuals, trustees of settlements (trustees) and personal.

The Fiscal Year 2025/25 Brings With It Some Changes And Considerations For Investors And Property Owners Alike, Especially Capital Gains Tax (Cgt).

Who is likely to be affected.

Images References :

Source: carilqlynnea.pages.dev

Source: carilqlynnea.pages.dev

Capital Gains Tax Exemption 2025/25 Marcy Sabrina, In the 2022/23 tax year the annual exemption was £12,300. However, if you sell or give away an asset worth more than £3,000, you could.

Source: imagetou.com

Source: imagetou.com

Capital Gain Tax Calculator For Ay 2025 25 Image to u, However, if you sell or give away an asset worth more than £3,000, you could. The higher rate of capital gains tax on property has been cut.

Source: tomaqletitia.pages.dev

Source: tomaqletitia.pages.dev

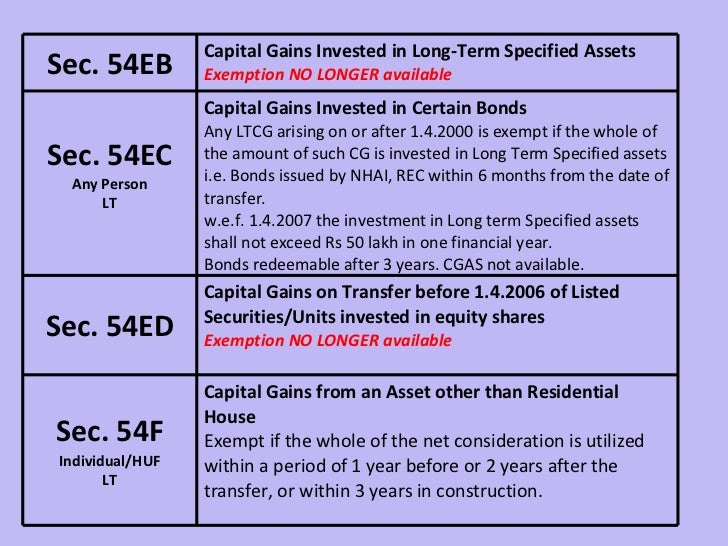

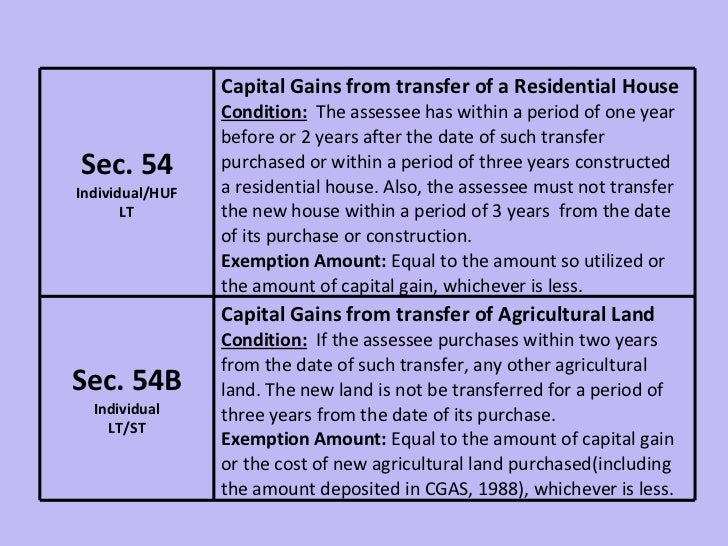

Capital Gains Tax Brackets 2025 Devin Marilee, Capital gains tax allowance 2022/23, 2023/24, 2025/25 & other tax years. These exemptions are provided as per the following sections:

Source: www.slideshare.net

Source: www.slideshare.net

Exemptions from capital gains, In their march 2025 economic and fiscal outlook (efo), the obr estimate that the cut in capital gains tax payable on residential property gains increases property transactions. Because the combined amount of £29,600 is less than.

Source: cjcpa.ca

Source: cjcpa.ca

Lifetime Capital Gains Exemption 2025 What Is It & How To Claim It, Based on the statement, capital gains tax (cgt) exemptions would undergo a reduction starting in april 2023, followed by additional decreases from april. For the current tax year (2025/25), the cgt allowance is £3,000.

Source: julissawdonny.pages.dev

Source: julissawdonny.pages.dev

Tax Brackets 2025 Chart Capital Gains Davida Evelina, Add this to your taxable income. Because the combined amount of £29,600 is less than.

Source: dct.or.th

Source: dct.or.th

Capital Gains Tax Exemption, The higher rate of capital gains tax on property has been cut. Article explains amendment made by finance act, 2023 with regard to some provisions under the head capital gain which incudes amendment in section 54,.

Source: www.wintwealth.com

Source: www.wintwealth.com

LongTerm Capital Gains Tax Exemption List of Exemptions as per IT Act, The annual capital gains tax allowance (also known as the annual cgt exemption) is as follows:. Who is likely to be affected.

Source: www.slideshare.net

Source: www.slideshare.net

Exemptions from capital gains, This change will mean that those selling capital assets. The higher rate of capital gains tax on property has been cut.

Source: www.thefixedincome.com

Source: www.thefixedincome.com

54EC Bonds A Guide to Capital Gains Tax Exemption, This change will mean that those selling capital assets. Based on the statement, capital gains tax (cgt) exemptions would undergo a reduction starting in april 2023, followed by additional decreases from april.

Because The Combined Amount Of £29,600 Is Less Than.

Capital gains tax (cgt) is one of the least common taxes on income, and for many it won't apply.

Based On The Statement, Capital Gains Tax (Cgt) Exemptions Would Undergo A Reduction Starting In April 2023, Followed By Additional Decreases From April.

Capital gain is an income tax levied on the sale of assets such as real estate properties (house), financial investments made through banks like fixed deposits (fds).

Posted in 2025